Transaction Master Summary Exceptions Report

Bullhorn Support is able to assist with navigating sample reports, but they are unable to build customizations on reports for you. If you need customizations, you will need a Business Intelligence specialist who is familiar with writing database queries.

The Transaction Master Summary Exceptions Report provides a color-coded visual representation of Candidate Placements that fall outside of the parameters you set. If there is an exception against one of the Exception Rules, the cell for the applicable rule will be red and include the word “Exception”. The color green indicates that the Exception Rule falls within the parameters you set.

The Transaction Master Summary Exceptions Report uses the Transaction Master Summary report as a base, and applies various exceptions parameters to the aggregate hours for the week. For example, if the exception is "OT > 10", the report looks for more than 10 hours of Overtime in the entire week.

This is one of three similarly-named reports, which provide visibility to the same data through a different lens. The other Transaction Master Reports are:

- Transaction Master Detail: Full line-by-line report of each pay and bill transaction.

- Transaction Master Summary: Rollup of the Transaction Master Detail report; summarized by Candidate Placement ID, Week Ending Date, and Earn Code.

The Transaction Master Summary Exceptions is a summary by Placement ID, by Weekending, by Earn Code. If

a Candidate has four earn codes for the week, you will see four rows

associated with the Candidate on the report: one row for each earn code.

All earn codes associated with the Candidate will be displayed, even if

only one of the earn codes has an exception against it.

This report only provides visibility in to the standard Earn

Codes - Reg (Regular), OT (Overtime), and DT (Doubletime). For agencies

leveraging multiple Reg, OT, or DT Earn Codes, the report will need to be

customized to support multiple earn codes for these categories.

| Data Item in Report | Definition |

|---|---|

| Reg Pay Hours Exception |

The Placement falls outside of the parameters set when running the report for Reg Hours earn code. This report currently identifies only the standard Reg Earn Code. If your agency incorporates multiple Reg earn codes, this exception will only include the standard Reg earn code. Future report enhancements are expected to allow for a broader range of Reg earn codes. |

| OT Pay Hours Exception |

The Placement falls outside of the parameters set when running the report for OT Hours earn code. Unlike the Reg Hours earn code, all OT earn codes will be captured and included in this exception. |

|

DT Pay Hours Exception |

The Placement falls outside of the parameters set when running the report for DT Hours earn code. Unlike Reg Hours earn code, all DT earn codes will be captured and included in this Exception. |

|

Total Pay Hours Exception |

The Total Pay Hours paid falls outside of the parameter set when running the report. This is a good “smoke test" to ensure a candidate hasn’t submitted a timesheet for an excessive number of hours. |

|

OT > Reg Hours Exception |

The number of OT hours is greater than the number of Reg hours for the candidate Placement ID. This report currently identifies only the standard Reg Earn Code. If your agency incorporates multiple Reg earn codes, this exception will only include the standard Reg earn code. Future report enhancements are expected to allow for a broader range of Reg earn codes. |

|

Unequal Pay Bill Hours Exception |

The number of Pay Hours does not match the number of Bill Hours for the earn code. This is a good “smoke test" to ensure that the agency is properly billing for hours that they are paying, or to determine that there is a legitimate reason why these are not billable, or vice versa. |

|

Pay Amount Exception |

The Pay Amount exceeds the threshold set as a report parameter. This is a good “smoke test" to ensure a candidate isn’t paid a huge amount due to an accident or a data entry error. |

|

Multiple Timecards Exception |

If you set “yes” as the parameter, this exception will identify the Candidate ID that has multiple time cards submitted during the designated time frame. Payroll may need to review to ensure time and bonuses are properly paid based on locality pay laws. |

|

Multiple Weekending Dates Exception |

If you set “yes” as the parameter, this exception will identify the Candidate ID that has multiple time cards which represent different week ending dates during the designated time frame. Payroll may need to review to ensure time and bonuses are properly paid based on locality pay laws. |

|

Pay > Bill Exception |

If you set “yes” as the parameter, this exception will identify the Candidate ID where the total pay amount exceeds the total bill amount. This is a good “smoke test" to ensure that the agency is properly billing for hours that they are paying, or to determine that there is a legitimate reason why these are not billable. |

|

Pay no Bill Exception |

If you set “yes” as the parameter, this exception will identify the Candidate ID where the candidate has a pay amount, but there is no bill amount associated with the placement. This is a good “smoke test" to ensure that the agency is properly billing for hours that they are paying, or to determine that there is a legitimate reason why these are not billable. |

|

Client |

Company Name from the Company Profile associated with the Placement |

|

Bill To Client Name |

Company Name to which the billing is sent, which can be different from the Client Name. Example: The candidate may be working at IBM; however, the invoice is sent to the MSP provider (e.g. Beeline). |

|

Candidate Name |

Candidate name listed on the Bullhorn Candidate profile. |

|

Candidate ID |

ID number automatically assigned by Bullhorn on the Candidate profile. |

|

Job ID |

ID number automatically assigned by Bullhorn on the Job Order profile. |

|

Job Title |

Job Title listed on the Bullhorn Job Order profile. |

| Placement ID |

ID number automatically assigned by Bullhorn on the Placement. |

|

Employee Type |

Employee Type selected on the Placement. Options include, but are not limited to: W2, T4, 1099. |

|

Employment Type |

Type of employment selected prior to entering the Placement data. Options include, but are not limited to: Contract, Contract to Hire, Permanent. |

|

Bill Item |

Represents the revenue category for the charge that is linked to a GL account; determined from the related earn code’s Bill Item field. This may be empty for agencies not leveraging Bill Items. |

|

Class |

General category to describe the Placement’s employment type (i.e. if the Employment Type is "Contract", then it is consultant hourly). Depending on the transaction, it is determined from the charge, Placement or related earn code. This field is typically utilized with QuickBooks. |

|

Period End Date |

The end date of the timecard associated with the transaction. |

|

Payable Charge ID |

ID number automatically assigned by Bullhorn on the Payable Charge. |

|

Pay Status |

Bullhorn Status of the Payable Charge. Options include: Exported, Processing, Export Error, Ready to Pay or Not Ready to Pay. |

|

Pay Transaction Status |

Status of the Timecard/Payable Charge. Options include: Submitted or Approved. |

| Pay Transaction Origin | Origin of the Pay Transaction Data. Options include: PeopleNet or Manual. |

| Pay Description |

Combined description of: Candidate Name, Job Title, and Period End Date. Example: Elizabeth Green - Inspector - 2022-01-09 |

| Pay Earn Code | Earn Code associated with pay being processed. Options include, but are not limited to: Reg, OT, DT, Per Diem, PTO, etc. |

| Pay Qty | Number of hours/units paid associated with the pay earn code. |

| Pay Amount | Pay Qty multiplied by Pay Rate. |

| Billable Charge ID | ID number automatically assigned by Bullhorn on the Billable Charge. |

| Bill Status | Bullhorn Status of the Billable Charge. Options include: Ready to Bill, Needs Review, Invoicing, Invoiced, Unbillable, Processing Failed, Processing, or Not Ready to Bill. |

| Bill Transaction Status | Status of the Timecard/Billable Charge. Options include: Approved or Submitted. |

| Bill Transaction Origin | Origin of the Bill Transaction Data. Options include: PeopleNet or Manual. |

|

Bill Description |

Combined description of: Candidate Name and Period End Date. Example: Elizabeth Green - 2022-01-09 |

|

Bill Earn Code |

Earn Code associated with billing being processed. Options include, but are not limited to: Reg, OT, DT, On Call, Call Back, etc. |

|

Bill Qty |

Unit of Measure associated with the bill earn code. Examples include: hours, units, days, or miles. |

|

Bill Amount |

Pay Qty multiplied by Bill Rate. |

Use Cases

Payroll and Billing Specialists should run this report as needed and/or before running your payroll and completing invoicing. Running this report after billing processes are completed gives you a quick data validation or “smoke test”. This can often surface any issues that may have occurred, so that they can be quickly addressed.

You can then use the Transaction Master Detail Report if additional detail is needed to research the exceptions.

Because of the urgency to review exceptions after pay and bill processes have completed, it is recommended to review the first page of the report, which provides a total number of exceptions identified per Exceptions Rule. If a significant number of exceptions are identified, it is a best practice to:

- Export the report to Excel.

- Share the Excel report with co-workers.

- Assign specific Exception Rules to each team member to research.

- Regroup as a team to discuss the Exception Rules that need to be addressed and resolved.

See Sample Transaction Master Summary Exceptions Report to view a full sample Transaction Master Summary Exceptions Report.

Running the Report

Manually entered transactions that are entered directly into your Payroll or Billing systems will not be included on this report.

-

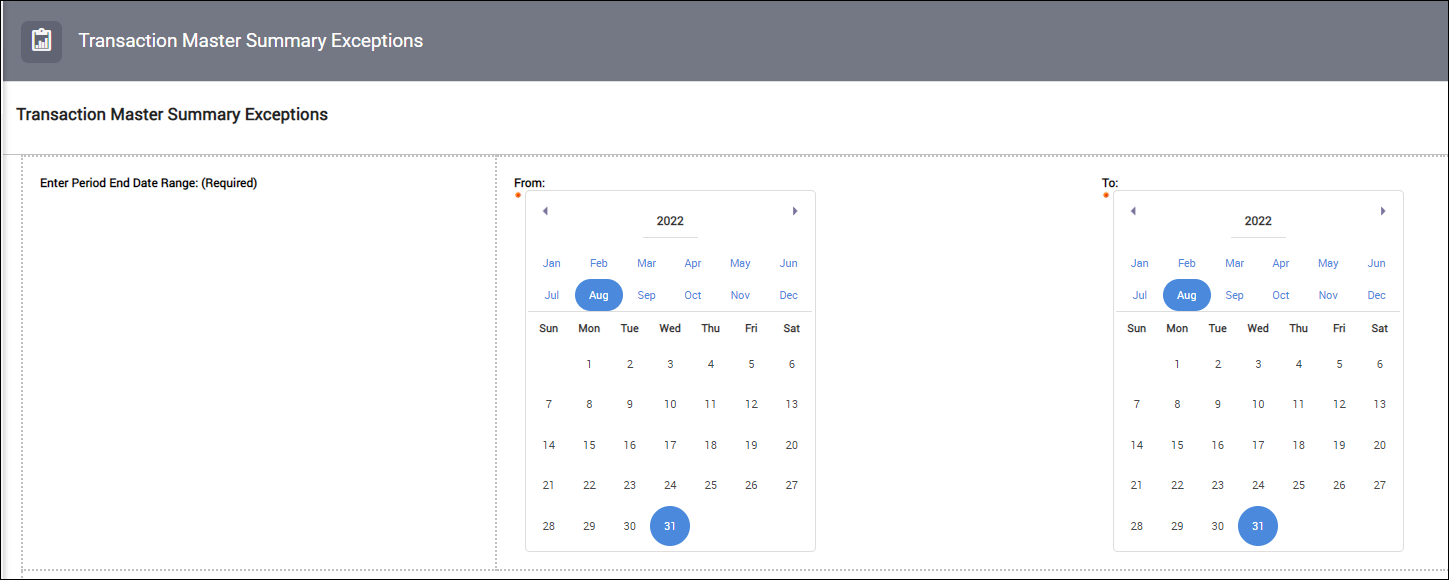

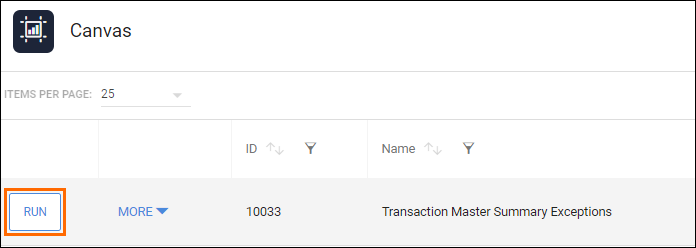

From the Bullhorn ATS Menu, select Canvas.

-

When Canvas opens, select Run beside the Transaction Master Summary Exception Report.

-

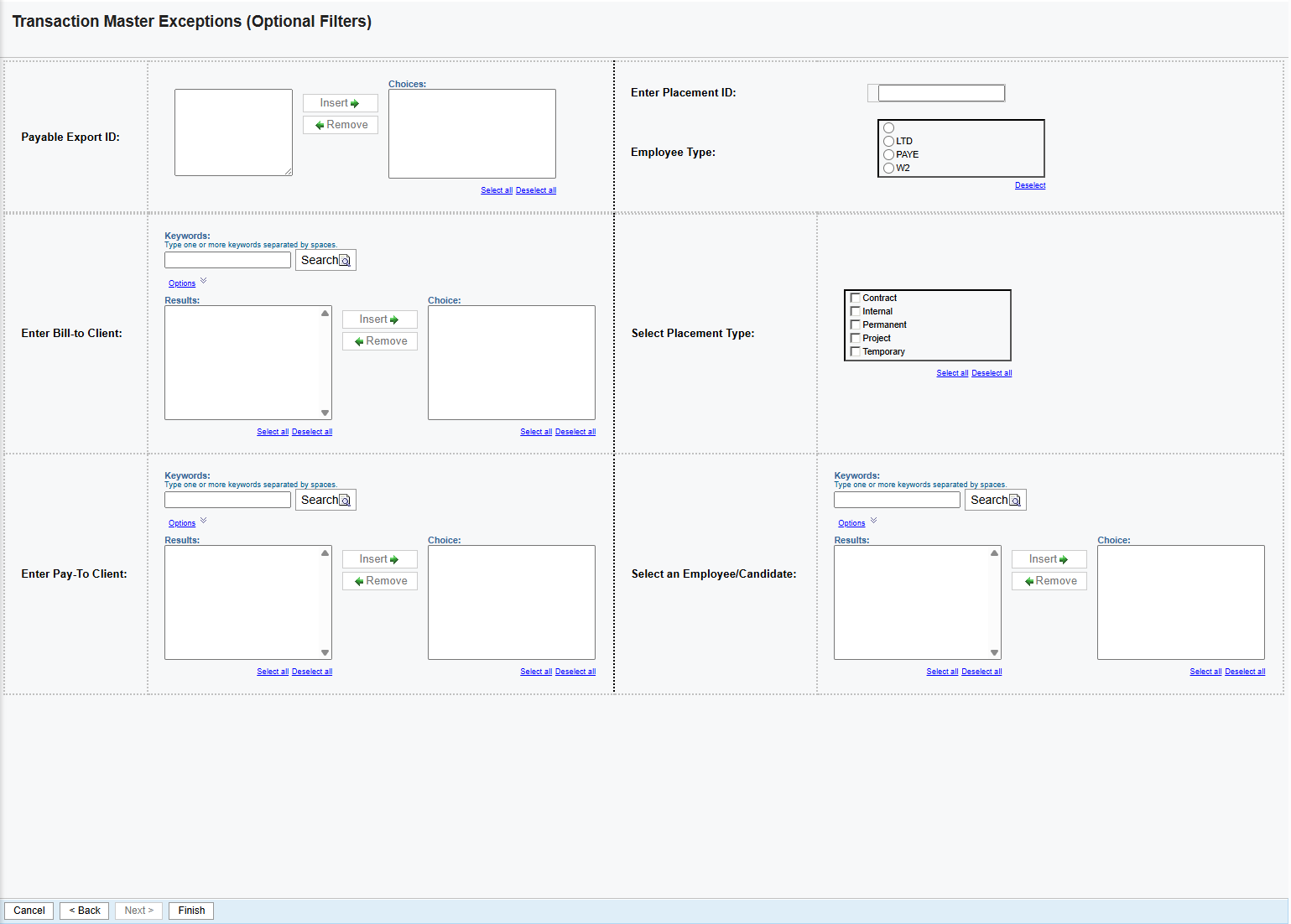

Enter the criteria for the report.

-

Period End Date Range: Choose the same amount of time your payroll is run for. For example, run this report for one week of data if you run payroll weekly. This is the only required criteria.

-

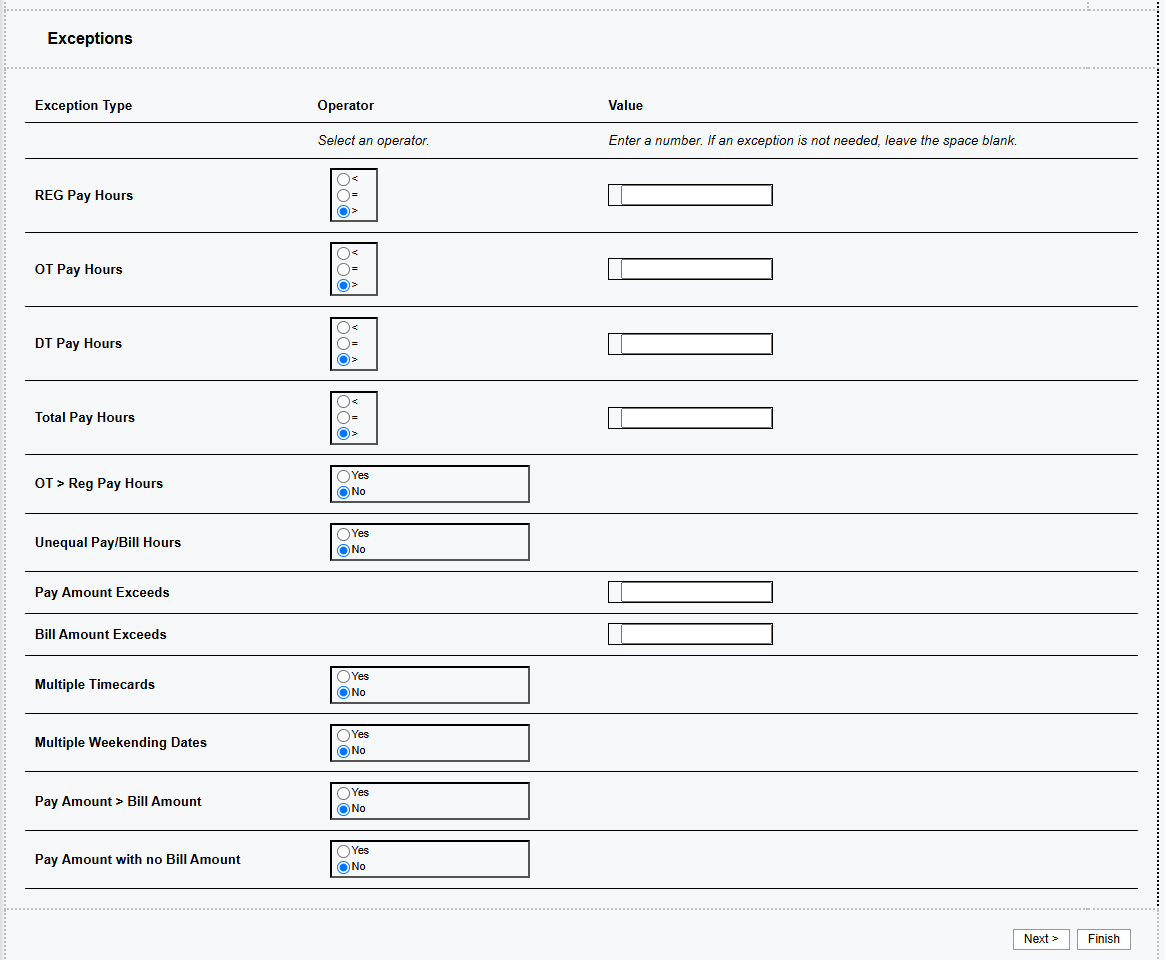

Exceptions: Add at least one exception before running this

report.

Exceptions: Add at least one exception before running this

report.

You can adjust the Exception Rule parameters to be agency-specific, client-specific, or for one-off scenarios. The chart below provides an overview of the available exception rules to run as part of the report.

- Each Exception Rule is optional; you can run the report with all or any combination of rules.

-

Some Exception rules include an operator, which provides additional

flexibility for you to customize the report. Operator examples include:

- < : less than

- > : greater than

- = : equals to

In the chart below, the "XX" represents your ability to enter a number parameter prior to running the report.

Exception Title Exception Criteria Reg Threshold "Operator " XX Regular Hours OT Threshold "Operator" XX OT Hours DT Threshold "Operator" XX DT Hours) Total Pay Hours Threshold Total Pay Hours > XX OT > Reg Pay Hours OT Hours > Reg Pay Hours Unequal Pay/Bill Hours (Pay & Bill Hours do not Match) Pay Hours != Bill Hours Pay Amount Exceeds Threshold Total Pay Amount > $X Exceeds Pay Rate Threshold Total Pay Rate > $X Multiple Timecards Yes or No Multiple Weekending Dates Yes or No Pay Amount > Bill Amount Yes or No Pay Amount with no Bill Amount Yes or No

-

-

Click Finish to run the report.

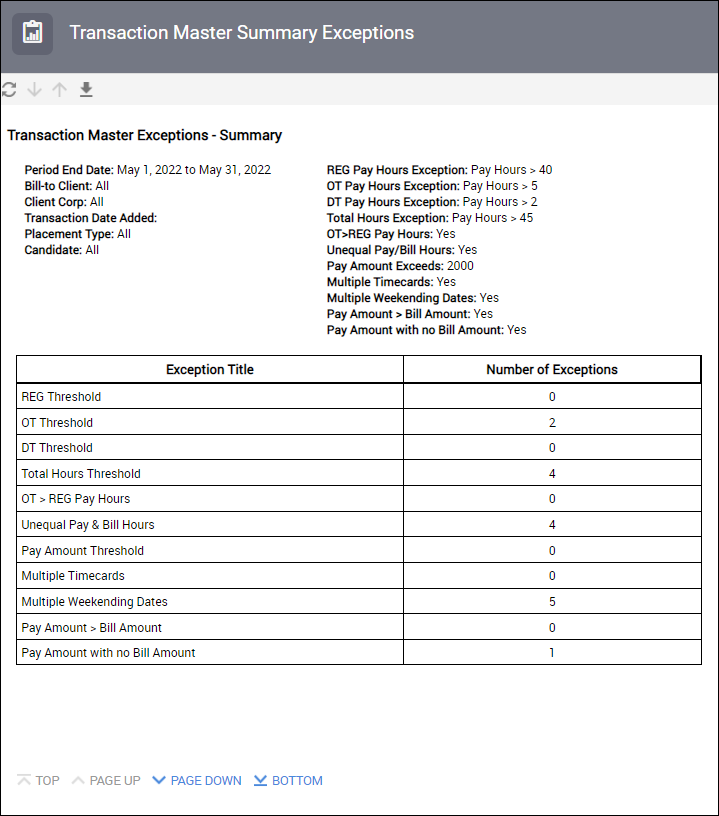

The initial screen will display the exception parameters for which the

report was run, and a total number of exceptions that were identified

for each Exception Rule. This gives you a snapshot of the volume and

types of Exceptions that were identified. The report details will display fully on the next screen.

You will only see transaction summary data on the report when there is at least one Exception Rule that falls outside of your parameters. If no exceptions are found, no transaction summary data will appear on the report.

Exporting to Excel

Depending on the amount of data, it may be easier to view the report via Excel. Follow these steps to export your report to Excel:

-

From the HTML drop down button in the top right corner, click View in Excel Options > View in Excel 2007 Format.

The Excel format you choose can be based on personal preference. We recommend using View in Excel 2007 Format to maintain the same format that you see in Bullhorn Reporting (Canvas) and/or if you plan to use standard Excel functions (pivot, sort, etc).

-

The request will process and a pop up stating "Your report is ready and will download to your Web browser in a few moments" will appear.

-

When prompted, Save the report to your computer.

Once the report is exported to Excel, you can utilize standard Excel functions to filter, sort and pivot the data.

Two tabs will display on the Transaction Master Summary Exceptions Excel report: Summary Totals, and Exception report.