Time Processing Rules Priority: Holiday Rules

This is Time & Labor functionality. To have Time & Labor enabled, contact your Account Manager.

's Time & Labor processing rules are set up at the Company, Job, and Placement levels so that when timesheets are submitted, the Time & Labor Rules Engine can interpret the timesheet according to the rules. Since hours can only be evaluated once by the Time & Labor Engine, it's important to understand how rules are applied and their processing order.

The table order below is reflective of the priority order (top to bottom) that the rules are applied during time evaluation. Rules marked as Default are automatically applied to the processing pipeline and can not be configured.

To update your company's rule priority order, contact Bullhorn Support.

| Time Processing Rule |

Category |

Description |

|---|---|---|

|

Reversal (Default) |

Threshold |

Supports diff calculations.. This rule has the highest priority in the processing pipeline since it has to ensure a clean slate. After the reversal rule is executed, other rules will run normally as if the previous calculation never existed. |

| Worked Holiday Threshold | Holidays | Time processing based on predefined holidays and one or more thresholds. |

| Day of the Week Premium | Threshold | Time processing based on a certain day or multiple days of the week in order to give a candidate a premium based on days. |

| Non-scheduled Workday | Threshold | Time processing based on a day of the week in order to allow a certain rate for days a candidate does not normally work. |

| 7th Day Threshold (Nth Day) | Threshold | Time processing based on a number of consecutive workdays. |

| Daily Threshold | Threshold | Time processing within a single day for one or more thresholds, so time worked beyond each threshold is paid at a premium rate. |

| Daily Min Wage Basis Threshold | Threshold | Time processing within a single day for one or more wage based thresholds; so if a candidate works over a certain amount of time at a certain regular pay rate, they are eligible for a premium rate beyond the threshold. |

| Period Threshold | Threshold | Time processing based on a processing period and one or more thresholds. |

| Orientation | Orientation | Time processing based on a new hire going through orientation. |

| Worked Holiday | Holidays | Time processing based on predefined holidays. |

| Period Based Quantity | PeriodBasedRate | Provides a set rate as a dollar type Earn Code for certain periods; for example, if a candidate that normally works a day shift is asked to work a night shift, they can be eligible for a bonus via a Period Based Quantity rule. |

| Guaranteed Hours | Exempt | Time processing that is not strictly tied to the number of reported hours; so on a week or a day where the candidate works less than a certain amount, they are given the hours they were guaranteed. |

| Low Census | Threshold |

This rule is specifically used by hospitals to call an employee off when there’s not enough demand. Most placements have a special clause that allows the hospital a certain number of call-offs per low census period. A low census call-off results in the employee getting paid but the hospital not getting billed or getting billed at a reduced bill rate. |

|

Expense Passthrough (Default) |

Expenses |

Supports expense processing. This is the only expense rule, as expenses do not need complex time and/or rate manipulation. |

|

Passthrough (Default) |

Threshold |

This rule consumes all remaining quantity entries. This rules happens later in processing to ensure hours are not depleted before other rules have the chance to process them. |

|

Shift Pricing (Default) |

System |

Applies to shift based pricing so special pay/bill rates can be applied to specific hours worked. This rule will always run as part of processing. However, if no Shifts are set at the Placement level, this rule will be skipped, as no entries will be identified with Shifts during preprocessing. |

| FLSA Adjustment | FLSA | Provides Overtime calculations for candidates who work jobs with different rates. If there is a difference between the normal Overtime calculation and the FLSA Overtime calculation, then an adjustment is added. |

|

Negligible Quantity (Default) |

Threshold |

Identifies small quantities that are considered negligible or zero quantities and ensures they are ignored. |

|

Eliminator (Default) |

Threshold |

|

Time & Labor offers two different types of Holiday rules: Worked Holiday Threshold and Worked Holiday. The outcome of interpretation may be different depending on the rule selected on the placement.

It's not expected that you would set up both the Worked Holiday Threshold Rule and the Worked Holiday Rule. If you need multiple Thresholds and multiple Target Earn Codes, use the Worked Holiday Threshold Rule.

Worked Holiday Threshold Rule

When an employee enters time under the Source Earn Code(s) (usually Regular) during a time period associated with the Holidays selected, then the time in excess Target Threshold hours gets attributed to the associated Target Earn Codes. You can choose multiple attributed Target Earn Codes for the Worked Holiday Threshold Rule.

The Worked Holiday rule runs before any Daily or Period Threshold Rules.

The following example uses Exact as the Evaluation Method. For more information on other Evaluation Methods, see Advanced Holiday Rules.

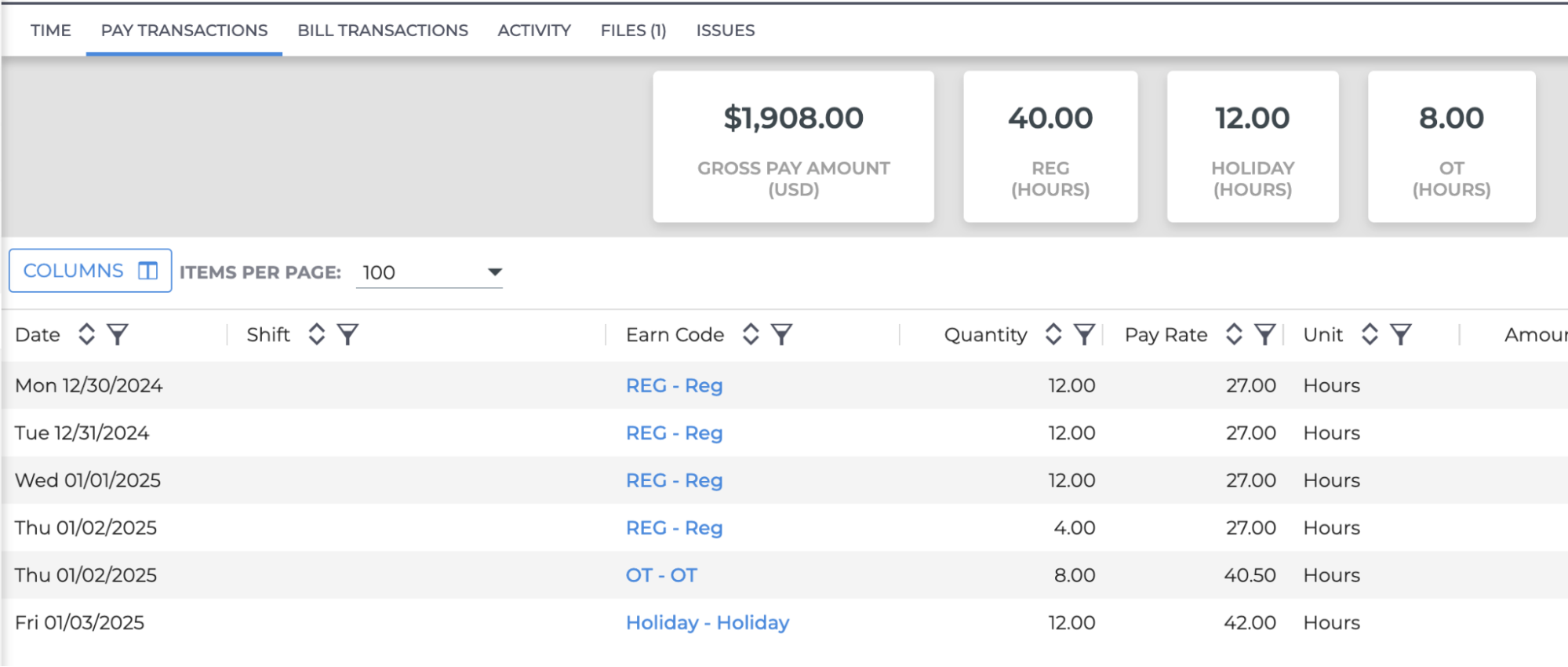

An employee works 12 hours per day during a five day work week for a total of 60 hours. The fifth day of that week is a Holiday. This placement has two rules that will run in the following order:

- Worked Holiday Threshold Rule: States that any hours over zero worked on that Holiday will be paid out as Holiday.

- Period Threshold Rule: States that any REG hours over 40 per week will be paid out as OT.

The evaluation of the hours based on these rules will be:

- 12 hours of Holiday: The hours for Holiday are identified and evaluated first and removed from the total hours from the week. 60 - 12 = 48.

- 8 hours of OT : The OT is evaluated based on the remaining hours.

- 40 Hours of REG: Since there are no other rules to run, the remaining 40 hours remain as REG.

Worked Holiday Rule

When an employee enters time against the Source Earn Code (usually Regular) during a time period associated with the holidays selected, then all hours are attributed under the Target Earn Code (typically Holiday). For the Worked Holiday Rule there is only one attributed Target Earn Code.

The Worked Holiday rule runs after any Daily or Period Threshold Rules.

The following example uses Exact as the Evaluation Method. For more information on other Evaluation Methods, see Advanced Holiday Rules. The example below assumes the Worked Holiday Threshold Rule isn't configured.

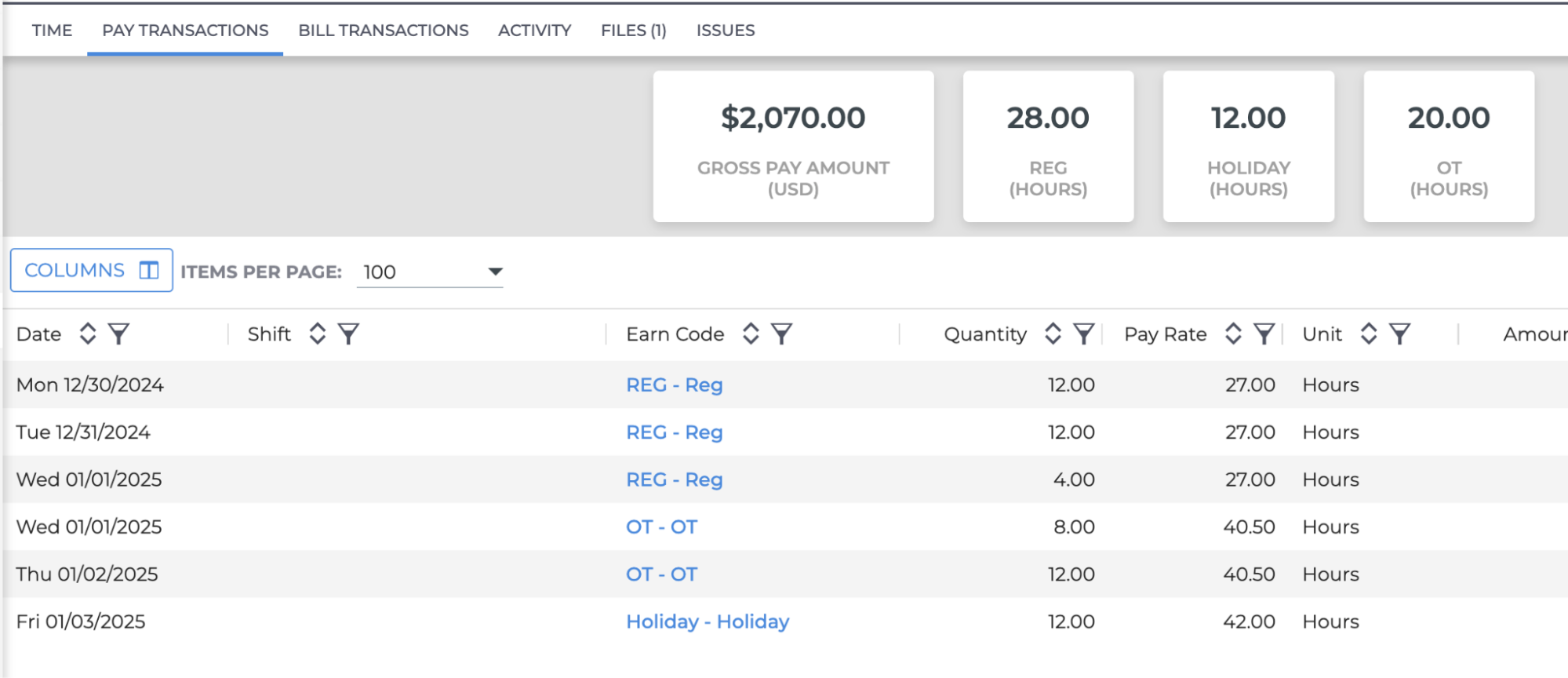

An employee works 12 hours per day during a five day work week for a total of 60 hours. The fifth day of that week is a Holiday. This placement has two rules that will run in the following order:

- Period Threshold Rule: States that any REG hours over 40 per week will be paid out as OT.

- Worked Holiday Rule: States that any hours worked on the Holiday will be evaluated as Holiday.

The evaluation of the hours based on these rules will be:

- 20 hours of OT : The OT hours are the first hours evaluated and subtracted from the total hours of 60. 40 hours remain.

- 12 hours of Holiday: The Holiday hours are evaluated and subtracted from 40.

- 28 Hours of REG: Since 40 - 12 = 28 and there are no further rules to run, we are left with 28 hours of REG.