| Package: TimeCards |

Back Office: Placement Types

The Back Office solution accommodates billing and invoicing for the three primary placement records noted below. Each placement record type has a different event trigger that initiates the Back Office workflows.

-

Temporary Placements - Invoice, Commission, and Profit records are generated from approved timecards.

-

Permanent Placements - Invoice and Commission records are generated when the status of the placement changes to "Filled."

-

Temp to Perm (or Conversion) Placements - Invoice and Commission records are generated when a Temporary or Temp to Perm placement is converted to a Permanent placement.

The sections below describe the key Back Office data that is required for each placement type, along with the resulting workflow.

Temporary Placements

Temporary Placement records are created within the Jobscience App by the recruiter, usually from the Applicant Management System (AMS) page. When using the AMS, all of the appropriate attributes of the Job Order are copied down to the Placement record. This is the recommended way of creating the placement.

Once the placement is created, the recruiter should enter or confirm the fields listed in the matrix. Once everything is set properly, the recruiter should change the status of the placement to Active. This triggers the creation of the timesheets for this placement and starts the notifications at the appropriate day.

| Field | Field API | Description |

| Pay Data | ||

| Start Date | ts2__Start_Date__c | Placement Start Date |

| End Date | ts2__End_Date__c | Placement End Date |

| Status | ts2__Status__c | Placement Status |

| Pay Rate | jstcl__Pay_Rate__c | Pay rate to the employee. |

| Per Diem | jstcl__Per_Diem__c | The hourly per diem rate that is paid to the employee, if applicable. |

| Gross Pay Rate | jstcl__GrossPayRate__c | Combined Pay Rate plus Per Diem rate. |

| Per Diem Cap | jstcl__PerDiemCap__c | Maximum number of hours per week that per diem is paid. |

| Timesheet Data | ||

| Timesheet Period | jstcl__Timesheet_Period__c | Determines the days that appear for each timesheet period (Weekly, Monthly, Semi-monthly, etc.). |

| Week Ending Day | jsctl__Week_Ending_Day__c | Last day of the standard work week (Sunday or Saturday). |

| Timesheet Format | jstcl__Timesheet_Format__c | Determines how workers enter hours (Hours Only or Start and End time). |

| Enable Expense Submission | jstcl__EnableExpenseSubmission__c | Allows expense entry on the timecard. |

| Holiday Calendar | jstcl__Holiday_Calendar __c | Calendar of days designated as a holiday. |

| Overtime Plan | jstcl__Overtime_Plan__c | Overtime plan that should be applied to the placement. Usually location-dependent. |

| Billing Data | ||

| Invoice Batch | jstcl__Invoice_Batch__c | Method for invoice consolidation for billing items. Options are noted in invoicing section. |

| Accounts Payable | jstcl__Accounts_Payable__c | The "Bill To" client contact who receives invoices. |

| Accounts Receivable | jstcl.Accounts_Receivable | The "Remit To" user for the Organization. |

| Invoice Processing Period | jsctl.Invoice_Period | Frequency for invoice processing, typically weekly. |

| Invoice Overtime | jsctl.Invoice_Overtime | Determines which Overtime method is used to bill the client. |

| Overtime Bill Rate | jstcl__Overtime_Bill_Rate__c | If applicable, custom Overtime rate that is billed to the client. This is typically negotiated. |

| Invoice Terms | jsctl__Terms__c | Client invoice terms. |

| Tax Percent | jstcl__Tax_Percent__c | Tax percentage, if sales tax should be charged on the invoice. |

Permanent Placements

Permanent Placements do not generate timesheets like Temp Placements. The key data needed for this process are:

-

Start Date

-

Salary

-

Fee %

-

Minimum Days on the Job for Payment

-

Discount along with any Reason

The Fee for this placement is calculated with the formula:

Fee = (Salary * Fee%) - Discount

The flow for Permanent Placement is as follows:

-

The Recruiter creates a Placement record with Perm Record Type, ideally from the AMS. The Status of the Placement Record is "New".

-

When the Client accepts the candidate with all the terms and conditions, the financial details are entered into the Placement Record. The Status is set to "Filled". This generates an invoice line item record for billing. The invoice for the permanent placement fee is processed based on the invoice batch method and the Invoice Processing Period defined on the placement.

-

If the candidate does not show up, or he quits before the Start Date + Min Days, the placement is canceled. This is a manual operation by a Recruiter. Placement Status is set to Canceled.

-

-

If nothing else changes, on Start Date + Min Days, an invoice, commission, and profit record are created for this placement and the status updates to Closed.

Temp to Perm Placements

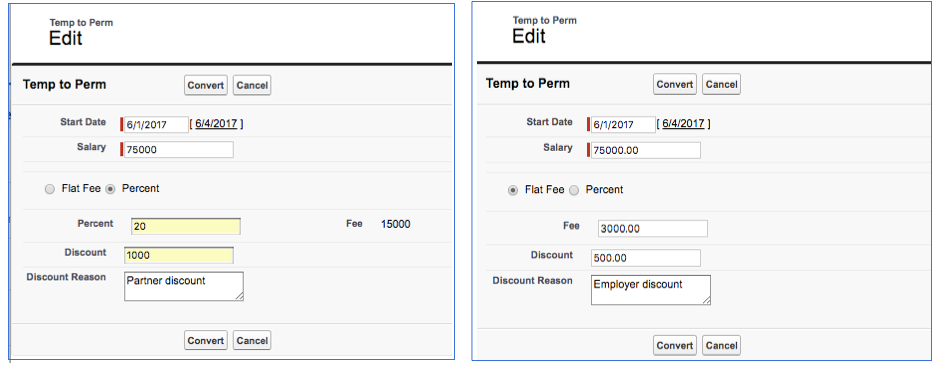

Temp to Perm conversions are common in the industry. A worker has been in a position for a period of time and the company decides they want to hire them as a permanent placement. The Temp to Perm button on the Temp or Temp to Perm placement initiates this process.

A popup window appears to capture the necessary information:

Two types of fees are common.

A Percentage Fee is common if the conversion happens early in the Temp Placement. The fee and possible discount tend more towards a Permanent placement where no Temp placement ever occurred.

If the candidate was in the Temp job for a long term, it is common that a smaller Flat Fee is paid.

When the form is completed and the Convert button is clicked:

-

A new Perm Placement record is created and cross-linked to the Temp Placement record using the Related Placement field.

-

The new Perm placement record copies over all of the common fields used between the two placement types, including Commissioned Users, Account, etc.

-

The Temp Placement record is changed to "Inactive" status.

-

All future pending timesheets, from the Temp placement, that have not yet been submitted are deleted.

-

All financial records are created for the permanent placement.

-

The fee for the temp to perm conversion generates an invoice line item when the status of the newly created permanent placement is updated to "Filled," similar to the process for regular permanent placement.

The billing-related required fields for Temp to Perm placement record type are similar to the required fields noted for Temp record type. They are essentially the same record type. Temp to Perm is used to track or manage the process for expected conversions.

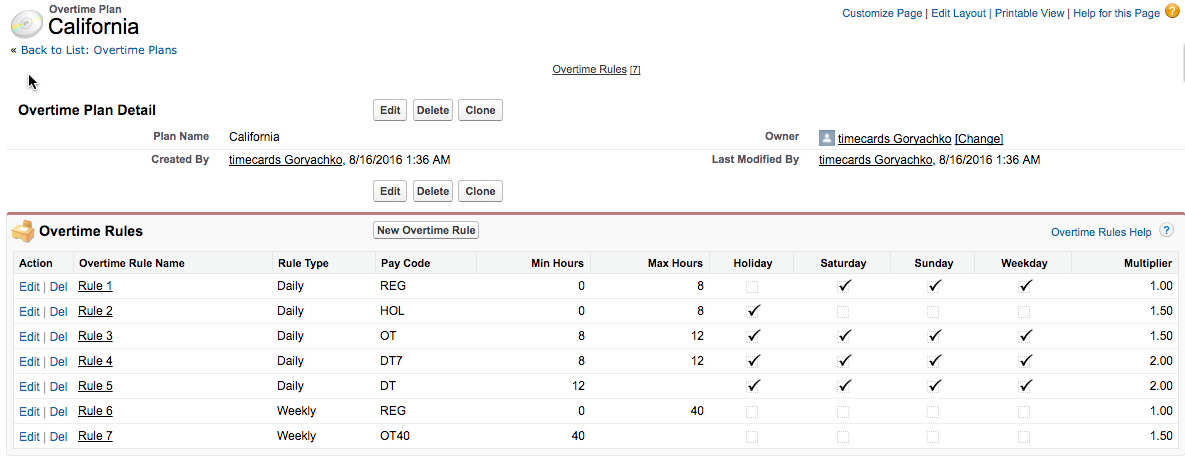

Overtime Plans

When a timesheet is approved, regular time and overtime hours are calculated separately to properly generate client billing and worker pay records. Each jurisdiction has its own rules so we provide a mechanism for each customer to associate a different Overtime Plan with workers in a given area. This plan is associated with each account and copied down to the placement for use by invoice generation.

As a Business User, most likely you are not required to understand how these rules are structured, only that they exist and provide overtime hours separate from regular hours. What is important for business users to understand is the impact on invoicing worker pay and client billing.

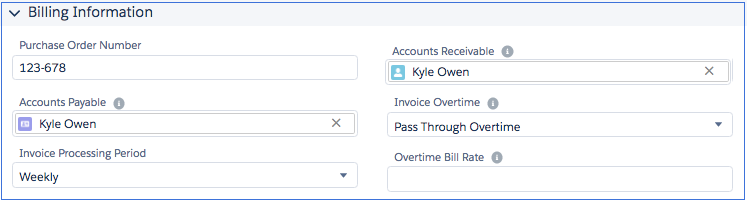

Client Billing for Overtime

Billing a client for overtime is not mandatory. Some companies pass overtime through with no markup in certain situations; others invoice the full amount with standard mark up. A staffing company may choose to place a single worker for 60 hours in two jobs instead of two workers for 30 hours each. In this case, they may need to eat the overtime pay and bill out all the hours as regular hours.

To handle these situations, we include a field on Accounts and Placements called Invoice Overtime with values:

-

Mark Up Overtime - Overtime is billed at a rate equal to the pay rate markup or Bill rate/Pay Rate. Example: Bill rate is $50 and pay rate is $35, overtime is billed at $50/$35 = 1.43*$50 = $71.50.

-

Pass Through Overtime - Overtime is billed using the overtime multiplier defined for the overtime plan that has been assigned to placement. Example: If the overtime multiplier is 1.5, overtime is billed at 1.5*Bill Rate (1.5*$50 = $75.00). Additionally, workers in states like California earn double time. In this case, the double time multiplier is 2.0 and the client is billed at a rate equal to 2.0*Bill Rate (2.0*$50 = $100.00).

-

Do Not Invoice Overtime - Overtime is billed at the regular bill rate. There is no markup or multiplier billed to overtime hours.

-

Use Overtime Bill Rate - Overtime is billed at a negotiated rate independent of any markup or multiplier. Example: Regular bill rate is $50, but the overtime bill rate has been negotiated to be $70. All overtime hours are billed at a rate of $70. When this option is selected for Invoice Overtime, an Overtime Bill Rate is required.

Overtime billing is shown as a separate line item on the client invoice.

Worker Overtime Pay

Overtime pay is designated on the placement. If a worker is qualified for overtime pay, Pay Overtime Rate should be set to yes. The worker earns an overtime pay rate based on the overtime plan that is associated to the placement. Typically, the overtime pay is consistent with the state rules where the work is being performed. Regular and overtime pay are calculated for each approved timesheet. The timesheet pay data is used for clients who integrate payroll processing with the Back Office.